Low drawdown, good sharpe ratio, expected payoff, profit factor, and recovery factor. But still has negative z-score? worry no more! let's explain here what's happening in your EA!

A negative Z-score in your EA (Expert Advisor) can indicate that the returns of the strategy are below average when adjusted for volatility. Here’s a breakdown of why this might be happening and whether it is something to be concerned about:

Understanding Z-score in Trading

The Z-score in trading often measures the statistical significance of the returns. Specifically, it compares the average return of your strategy to the risk-free rate (or sometimes just the average return) adjusted for the volatility of those returns.

Possible Reasons for Negative Z-score

- High Volatility: Even if you have good metrics like a high Sharpe ratio, if the volatility of your returns is relatively high, it can result in a negative Z-score.

- Small Sample Size: If the number of trades or the duration of the backtest is small, statistical measures like the Z-score can be less reliable.

- Return Distribution: The distribution of returns might not be normal, which can impact the Z-score calculation.

- Infrequent Positive Returns: If your strategy generates profits infrequently but large profits when it does, it might still show a negative Z-score due to a higher number of small losses or breakeven trades.

Should You Expect a Positive Z-score?

Ideally, with good metrics like a high Sharpe ratio, good expected payoff, and low drawdown, one would expect a positive Z-score. However, due to the reasons mentioned above, it might not always be the case.

Evaluating the Situation

- Re-evaluate Volatility: Check the volatility of your returns. A higher volatility can skew the Z-score.

- Increase Sample Size: Ensure you have a sufficiently large sample size for your backtest. The more data points, the more reliable the Z-score.

- Check for Normality: Assess whether the returns are normally distributed. If not, consider alternative statistical measures.

- Context of Z-score: Remember that Z-score is just one measure. If other metrics are good and the strategy performs well in real-world trading, the Z-score might be less significant.

What is z-score and how to interpret it in the context of algorithmic trading?

The Z-score in the MT5 Strategy Tester Result is a statistical measure used to evaluate the distribution of your trading strategy's returns. It helps determine whether the returns are statistically significant or whether they could have occurred by chance.

Understanding the Z-score in MT5 Strategy Tester

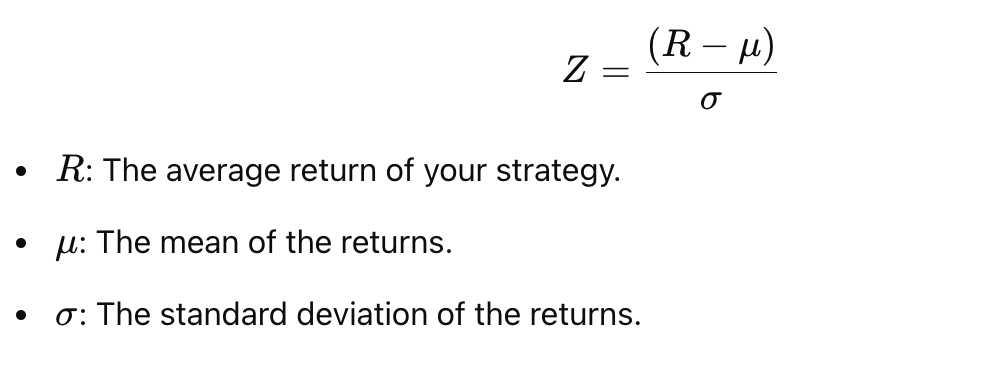

- Definition: In the context of MT5, the Z-score is often used to measure the likelihood that the trading results are random or not. It compares the average return to the standard deviation of returns, assessing how many standard deviations a data point (in this case, your trading returns) is from the mean.

- Formula:

Interpreting the Z-score in MT5

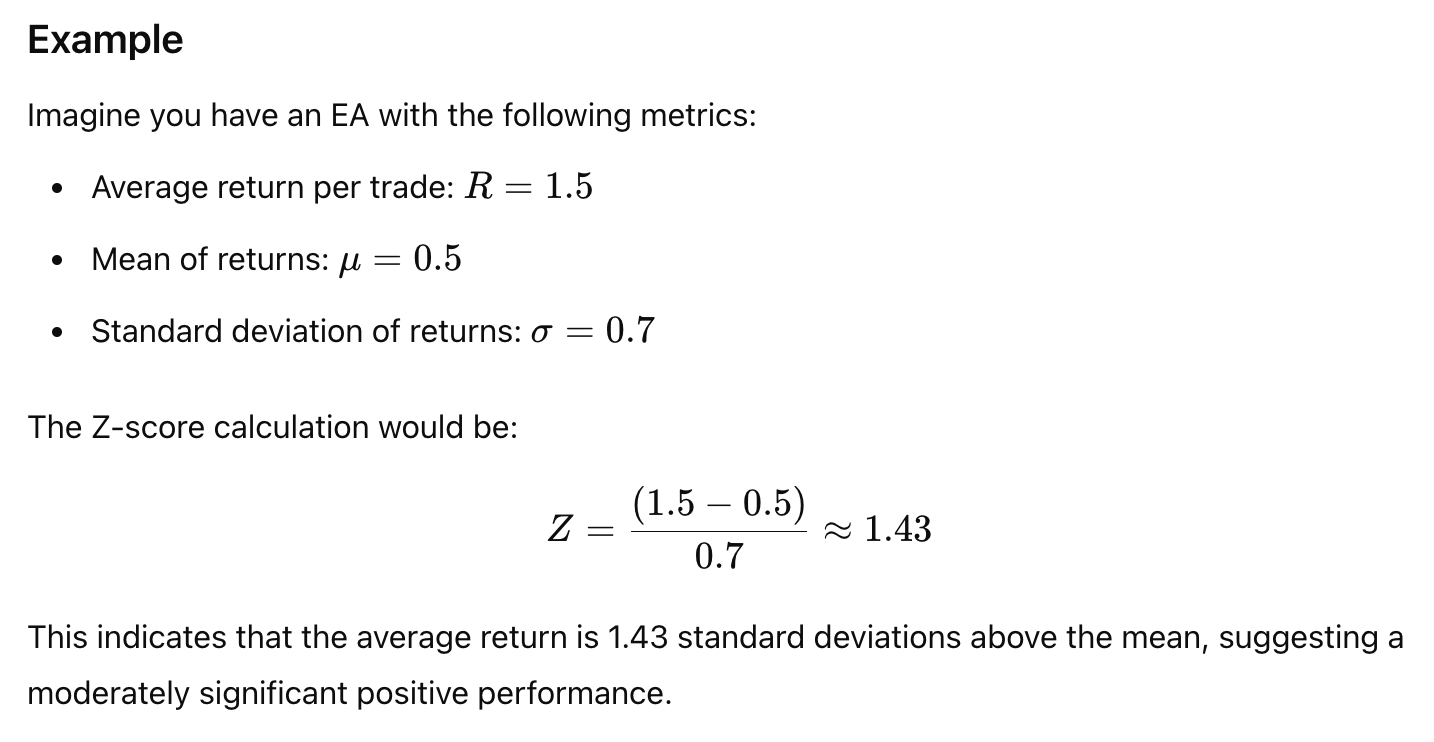

- Positive Z-score: A positive Z-score indicates that the returns are above the mean, adjusted for volatility. The higher the Z-score, the less likely the returns are due to random chance and the more likely they are due to a genuine edge in your trading strategy.

- Negative Z-score: A negative Z-score indicates that the returns are below the mean, suggesting that the strategy might not be performing well when adjusted for volatility.

- Magnitude of Z-score: The absolute value of the Z-score indicates how far your returns are from the mean in terms of standard deviations.

- A Z-score of 0 means the returns are exactly at the mean.

- A Z-score of 1 means the returns are one standard deviation above the mean.

- A Z-score of -1 means the returns are one standard deviation below the mean.

Interpreting Specific Values

- Z-score > 2: Indicates strong evidence that the returns are significantly better than random chance.

- Z-score between 1 and 2: Indicates moderate evidence of a genuine trading edge.

- Z-score between -1 and 1: Indicates that the returns are close to the mean and might not be statistically significant.

- Z-score < -1: Indicates that the returns are significantly below the mean, suggesting poor performance.

Practical Use in Trading

- Strategy Validation: A positive and high Z-score can help validate that your strategy has a real edge and is not just performing well due to random chance.

- Risk Management: A negative Z-score might prompt you to re-evaluate your strategy, possibly adjusting risk parameters or seeking other improvements.

- Confidence in Results: A high Z-score can give you more confidence in deploying your strategy in a live trading environment.

Conclusion

The Z-score in the MT5 Strategy Tester is a valuable tool for assessing the statistical significance of your trading strategy's returns. By understanding and interpreting the Z-score correctly, you can gain insights into the robustness and reliability of your trading strategy.

While a negative Z-score can be a point of concern, it’s not necessarily a deal-breaker if other performance metrics are strong. It’s important to understand the reasons behind it and consider the context in which it is occurring. Adjustments in strategy or further analysis may be required to align the Z-score with the other positive performance metrics.

Z-score in Algorithmic Trading