𝗪𝗵𝗮𝘁 𝗶𝘀 𝗥𝗶𝘀𝗸 𝗼𝗳 𝗥𝘂𝗶𝗻?

Risk of Ruin is a concept commonly used in finance, and risk management. It refers to the probability of losing an entire investment or bankroll, resulting in complete financial ruin or bankruptcy.In finance, risk of ruin can apply to various scenarios, such as the likelihood of a company going bankrupt or an investor losing all their capital due to a series of poor investment decisions.

Calculating the risk of ruin involves assessing factors such as the probability of winning or losing each bet or trade, the size of the bets or investments, and the number of bets or trades made over time.

By understanding and managing the risk of ruin, individuals and organizations can better protect themselves from catastrophic losses and improve their long-term financial sustainability.

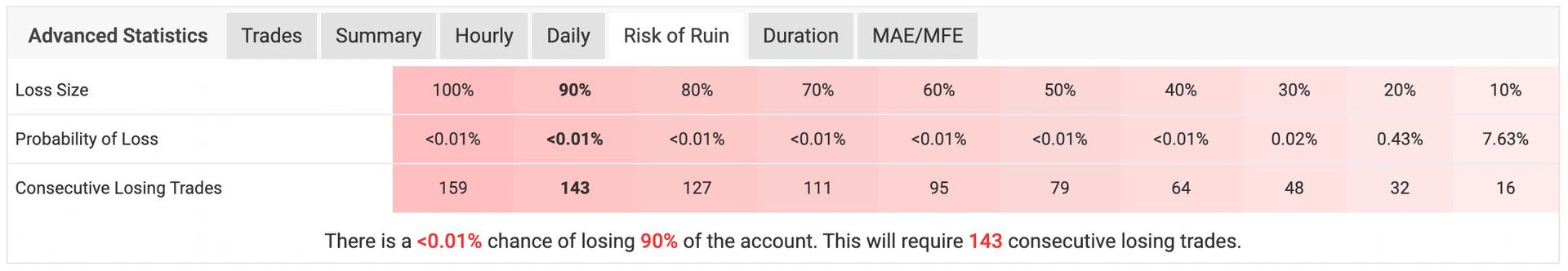

𝗜𝗻 𝗼𝘂𝗿 𝗔𝘁𝗵𝗲𝗻𝗮 𝗔𝗹𝗴𝗼𝗿𝗶𝘁𝗵𝗺, 𝘁𝗵𝗲𝗿𝗲 𝗶𝘀 𝗮 <𝟬.𝟬𝟭% 𝗰𝗵𝗮𝗻𝗰𝗲 𝗼𝗳 𝗹𝗼𝘀𝗶𝗻𝗴 𝟵𝟬% 𝗼𝗳 𝘁𝗵𝗲 𝗮𝗰𝗰𝗼𝘂𝗻𝘁, 𝗮𝘀 𝗹𝗼𝗻𝗴 𝗮𝘀 𝘁𝗵𝗲 𝗯𝗮𝗹𝗮𝗻𝗰𝗲 𝗶𝘀 𝗮𝗯𝗼𝘃𝗲 𝘁𝗵𝗲 𝗺𝗶𝗻𝗶𝗺𝘂𝗺 𝗿𝗲𝗾𝘂𝗶𝗿𝗲𝗱 𝗰𝗮𝗽𝗶𝘁𝗮𝗹. 𝗧𝗵𝗶𝘀 𝘄𝗶𝗹𝗹 𝗿𝗲𝗾𝘂𝗶𝗿𝗲 𝟭𝟰𝟯 𝗰𝗼𝗻𝘀𝗲𝗰𝘂𝘁𝗶𝘃𝗲 𝗹𝗼𝘀𝗶𝗻𝗴 𝘁𝗿𝗮𝗱𝗲𝘀.

Risk of Ruin